Economic & Financial Markets Update – August 2018

Sharemarkets continued to perform strongly over the course of the 2018 financial year, whilst fixed rate bond markets begun to experience headwinds as expectations increased for the further reduction of Central Bank monetary stimulus.

| Market Benchmarks | 6M | 1YR | 5YR (p.a.) |

| Australian Shares | 4.3% | 13.2% | 10.0% |

| International Shares | 6.4% | 15.4% | 14.9% |

| Australian Property | 3.0% | 13.2% | 12.2% |

| Australian Bonds | 1.7% | 3.1% | 4.6% |

| International Bonds | 0.1% | 1.9% | 5.0% |

| Cash | 0.7% | 1.5% | 1.9% |

to 30 June 2018

International Outlook

Underpinning solid returns from shares (business equity) was an improving global economy benefiting from fiscal and monetary stimulus measures and the energy price collapse of 2014 and 2015. The latter has represented a reduction in operating costs for government, business and household sectors globally.

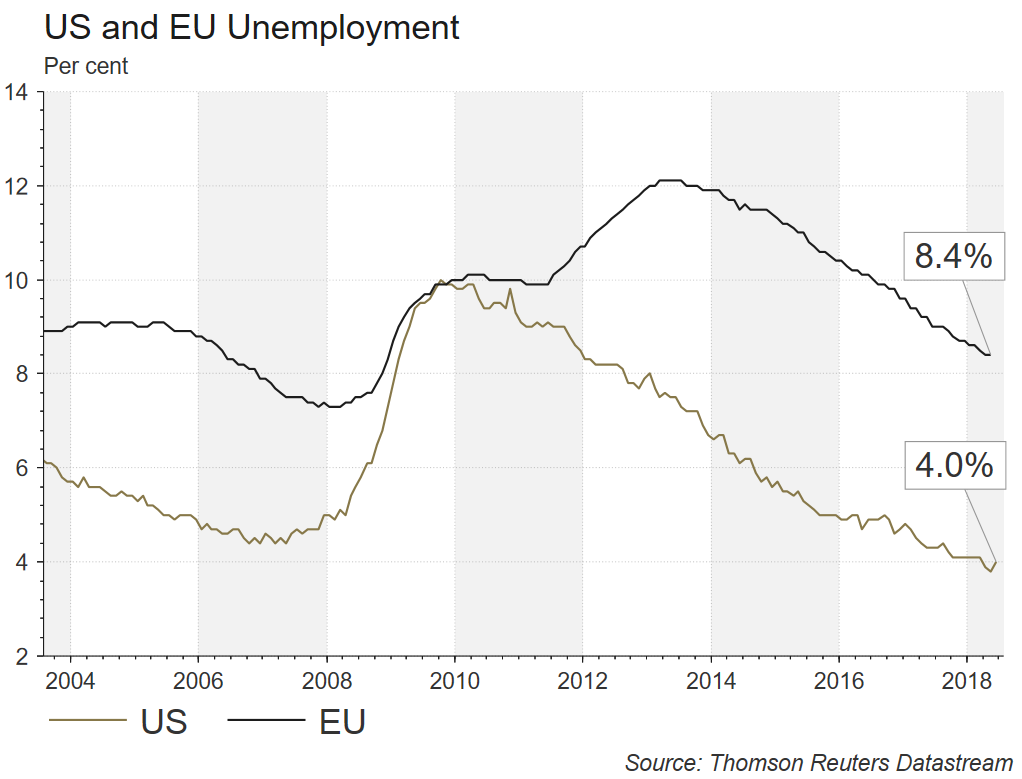

The US is now running at full employment, and conditions in the EU have improved substantially from the cyclical lows in 2014 as highlighted by the below chart.

In the EU youth unemployment has also shown a strong improvement recovering from nearly 25% at the peak of the crisis to below 17% today. Clearly the old world still has much work to do, with labour market and other economic reforms required to continue the positive trajectory beyond the current cyclical recovery.

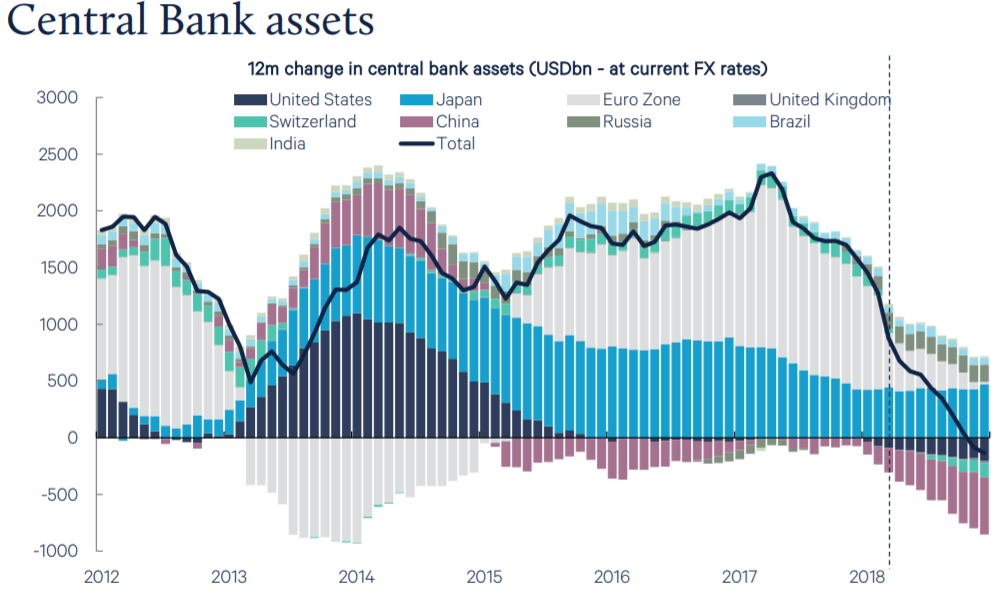

Central banks are now looking to accelerate the unwinding of monetary stimulus. Indeed in the US the Federal Reserve’s (Fed) expectation of three rate rises in 2018 has expanded to four, and both the Fed and the European Central Bank are expected to begin reducing Quantitative Easing programs (printing money to buy bonds) later this year. The Bank of Japan has also signalled that it is considering relaxing its program.

Source: Wilson Asset Management

This represents an important inflection point for markets. Buying bonds en masse with the primary goal of driving down borrowing costs to stimulate economic growth, has arguably worked but has shifted unquantifiable amounts of capital into higher risk asset such as shares as investors have searched for real returns. There is potential for a meaningful portion of this capital to shift back to its natural home in bonds as Central Bank intervention declines. This may create a headwind for share valuations.

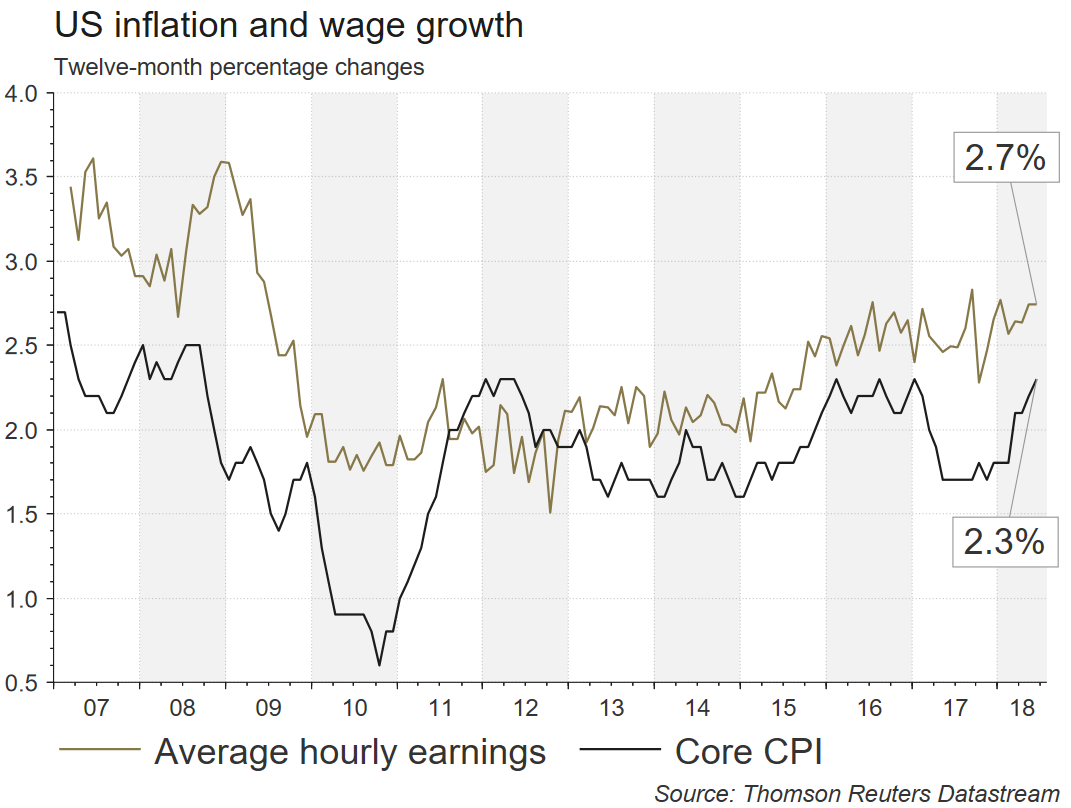

This may happen quicker than is expected if inflation accelerates assisted by wages growth, fiscal stimulus (tax cuts, infrastructure spending etc), rising energy prices and tariffs (more discussion on these below). Accelerating inflation would force the Fed to implement rate rises and/or unwind Quantitative Easing faster.

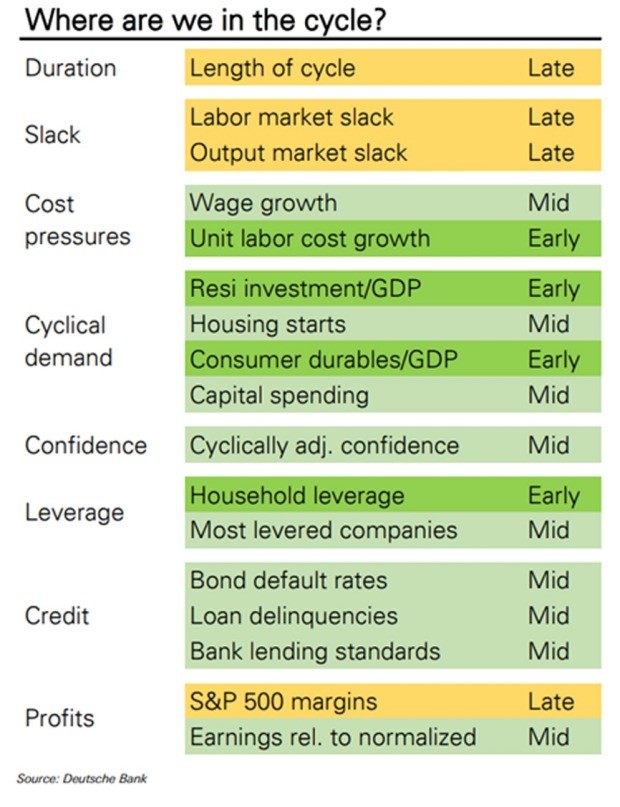

Hence the market is debating whether we are at the late stage of the current financial market/economic cycle. There continues to be strong arguments on either side of the coin, however, we lean towards the middle ground with an expectation that returns from shares will be lower going forward.

Underlying economic fundamentals in the US are strong, but as per the following summary indicators suggest that it is closer to mid cycle than late and at risk of overheating. As the cycle matures it is possible that corporate earnings growth will also accelerate supporting valuations.

In Europe, subject to political stability remaining, momentum is also solid. Manufacturing and industry continue to benefit from a low Euro and a range of indicators signal the recovery is gathering pace further supporting corporate earnings.

The Chinese economy is showing signs of rebalancing from construction investment to consumption, although it remains early days and authorities continue to engage in stimulatory measures to support growth targets. Trade facing sectors have stabilised with the acceleration of the US economy and recovery of Europe.

Trade Wars

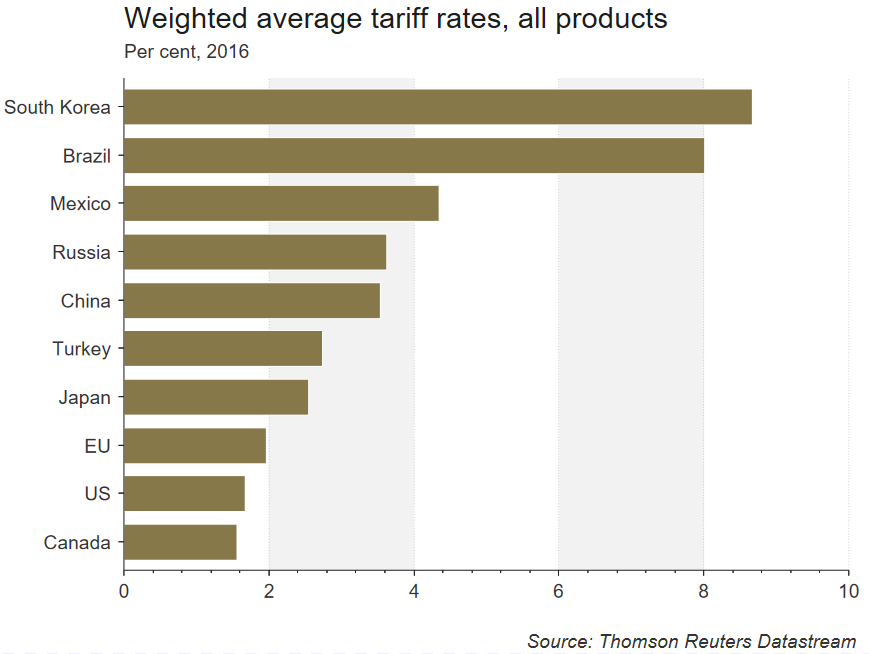

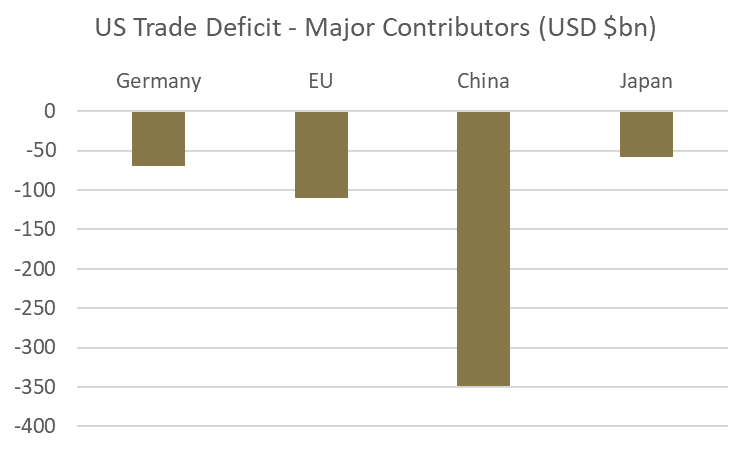

A spiralling battle to impose tariffs and counter tariffs are a risk to the economic outlook. Economists argue that this was a key contributor to the Great Depression, collapsing global trade at a time when it needed promoting and prolonging the recovery period.

Arguably impacts could be more acute in a more globalised world where countries are far less self-sufficient in the production of the goods that they need. Tariffs can be highly inflationary as production of goods and services shift away from the most efficient production centres and increased costs are passed on to consumers.

Counter-arguments of national security concerns, market dumping, inequality in operating landscapes, currency manipulation and intellectual property theft are generally viewed as genuine and fair. It does strike us as ironic that China, the least liberalised of the large economies, is retaliating to US attempts to ‘even up the game’.

Ultimately we view a deep escalation of trade barriers as unlikely and the core of the Trump Administration’s agenda to tackle the US’s multi-decade trade deficit by pressuring key trading partners to undertake market reforms as achievable. Indeed there has recently been a notional agreement between the US and EU to work towards zero tariffs.

Source: Thomson Reuters

Australian Outlook

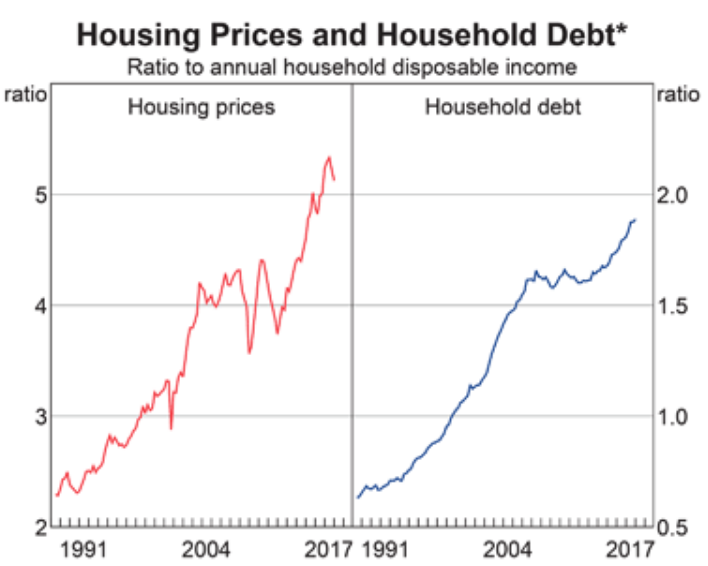

The consumer (household) credit cycle In Australia appears to have peaked and there is potential for a step change in availability of debt as a result of a change in lending standards. One of the outcomes of the Financial Services Royal Commission has been to uncover a further deficiency in lending standards where banks were assessing living expenses using very unrealistic benchmarks. The result of this was to substantially increase the amount credit that may otherwise have been extended to households. Banks are now hurriedly applying more realistic measures which will have the opposite effect.

Source: RBA

Reducing credit supply at what appears to be the top of the credit/housing cycle creates additional risk in our view with underestimated multiplier effects through the economy as households spending capacity is reduced. Additionally increases in global interest rates are driving up the cost of borrowing for Australian banks who continue to source 30% plus of their funding from offshore. We expect this to be passed on to borrowers through ‘out of cycle’ rates rises on their home loans creating further pressures.

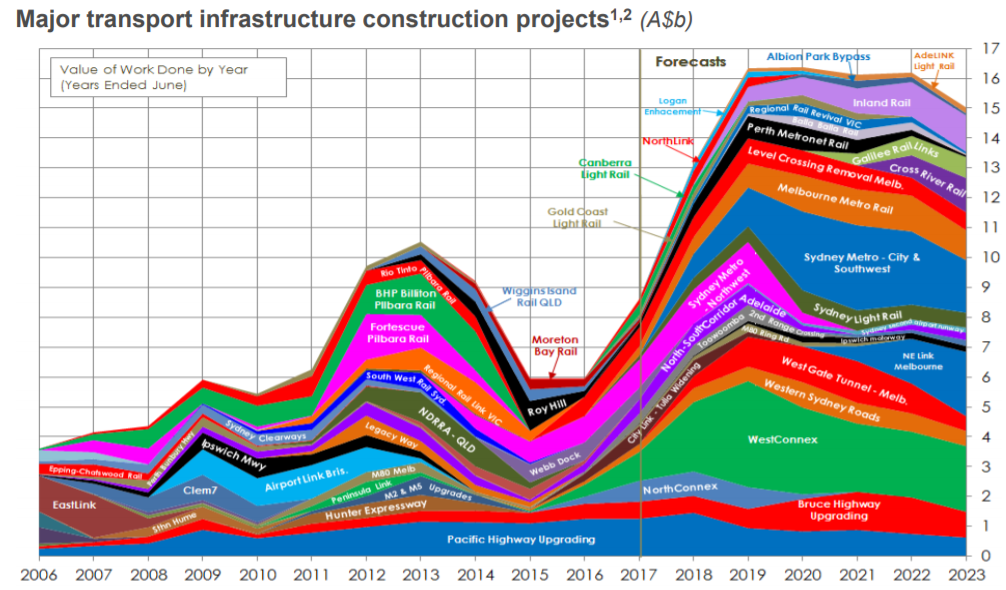

Whilst this paints a fairly negative picture Australia remains in a strong position. Government and corporate balance sheets are healthy and have capacity to increase investment. The outlook for infrastructure developments is strong and we expect the pipeline to keep growing. In the event of any deterioration in the domestic outlook it is likely that the determination to retain a triple A credit rating will be swept aside and further Government spending announced.

Source: Boral Limited

Furthermore there is potential for the immigration to be increased, albeit this will be equally as politically challenging. Also the Australian dollar acts as a natural hedge with a fall driven by a downturn increasing the relative competitiveness of Australia as an investment destination.

Overall we remain cautious on the medium term outlook for Australia.

Portfolio Positioning

In light of these views we continue to manage portfolios with a disciplined approach to valuation, a focus on quality businesses that have strong tailwinds, and a keen eye on liquidity.

Within the Australian Shares segment we have continued to progressively reduce exposure to consumer facing cyclical companies, including banks whose dividends have the potential to be volatile.

Several high quality companies that we remain very attracted to continue to trade at valuations that stagger us. The below have seen substantial expansion of already very high earnings multiples over the last 12 months despite the outlook for earnings growth mostly diminishing.

|

Valuation Multiple Expansion |

Growth Outlook Expansion |

|

| CSL |

27% |

-35% |

| Cochlear |

19% |

6% |

| Realestate.com.au |

21% |

-10% |

| Resmed |

23% |

-8% |

| Woolworths |

0% |

-37% |

| Sonic Healthcare |

14% |

-34% |

We have increased exposure to International Shares, and also have a strong weighting to Australian companies whose earnings are largely derived from offshore. Where we have used specialised fund managers to do so we have been careful to use those that have a disciplined approach to valuation. The prospects for these companies are generally stronger with better underlying economic outlooks, and there is also a natural protection from the Australian dollar as these investments have almost wholly been made on an unhedged basis.

We have taken very selective exposure to credit securities, and at this stage are avoiding fixed rate bonds whose capital value will decline in a rising interest rate environment (when yields go up prices go down as they become relatively less attractive).

We are seeing technological developments and the emergence of disruptive business models that amaze. Many are far from commercialisation and impacting traditional industries, nevertheless we are keeping a close eye on these and recognise the need to be more willing to adjust positions for change than has been necessary in the past.

Overall returns from cash, term deposit and bonds remain insufficient to offset rising inflation. Consequently investment in shares (equity in businesses that can pass through rising input costs to customers) remains our preferred asset class for investment (within the guidelines of your selected investment strategy).

The information contained in this article is general information only. It has not been prepared taking into account any person’s particular needs, financial situation or investment objectives, and should not be relied upon as a substitute for financial or other specialist advice.