Economic & Financial Markets Update – January 2020

Much of the returns from investment markets in 2019 came in the first six months of the year, although share markets rallied strongly in the lead up to Christmas. Underlying the headline numbers there were wide variances in returns from different sectors with cross currents of business fundamentals and falling interest rates impacting share prices. Overall the latter was the primary driver of returns.

| Market Benchmarks | 6M | 1YR | 5YR |

| Australian Shares | 3.3% | 23.8% | 9.1% |

| International Shares | 9.1% | 28.0% | 12.2% |

| Australian Property | 0.4% | 19.6% | 11.2% |

| Australian Bonds | 0.6% | 7.7% | 4.3% |

| International Bonds | 1.6% | 7.2% | 4.2% |

| Cash | 0.4% | 1.2% | 1.6% |

To 31 December 2019 in AUD terms.

Market Outlook

As discussed in our August 2019 newsletter lower interest rates make all other assets look relatively more attractive than cash, term deposits and bonds. Adjustment to these unprecedented settings was progressive through the course of the year with analysts slowly changing the assumptions that they make to generate company valuations.

Whilst this has the potential to continue there are signs of a more positive economic outlook, both globally and domestically, which drove bond yields a little higher over the course of the final quarter of 2019 and may continue through 2020.

Should this occur it is possible that valuations on some companies will be lowered, particularly companies with high growth in revenue or users, but poor medium-term profitability prospects, and blue chips with stable earnings streams. These two segments have been bid up aggressively by the market.

This is very short term focused but it is important for us to understand this dynamic in seeking to deliver on our dual ambition of both sufficiently growing your capital to meet your needs, and protecting it. Although overall shares provide the best prospects for generating returns above inflation, and protect capital better in a higher inflation environment, there are meaningful segments of imbalance and exuberance within markets perpetuated by low interest rates.

It is possible that interest rates naturally correct higher as pessimism recedes with better economic data or with increasing expectations of fiscal stimulus from governments.

Having said this, monetary stimulus (which puts downward pressure on interest rates) continues to increase. The US Federal Reserve (Fed) made three cuts to its Funds Rate over the second half of 2019 and has again started increasing the size of its balance sheet. At home the Reserve Bank of Australia (RBA) has reduced its Cash Rate to 0.75%, with further cuts expected in early 2020, and has begun signalling that an Australian version of Quantitative Easing is increasingly possible.

Global Economy

As discussed previously the U-turn in global central bank policy has been driven by weakening in leading economic indicators in key economies, primarily in their industrial sectors. This has been perpetuated by poor sentiment created by the trade and technology dispute between the US and China.

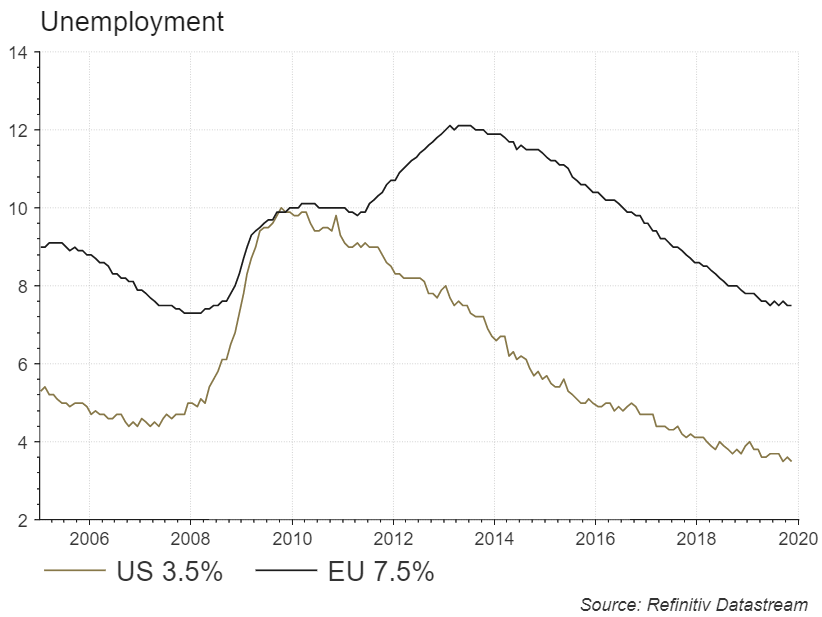

Whilst this has been a cause for concern, importantly it has not meaningfully flowed through to the much larger consumer and services parts of economies or jobs. Broadly speaking these sectors remain solid. The US created 2.1m jobs over 2019, a solid number although below the average of the post GFC period of 2.5m per year. Jobless claims, unemployment (3.5%) and underemployment (6.7%) are at or near historically low levels. The latter have been assisted by a step down in workforce participation since the GFC, however, there are 14m more jobs than there were prior to the GFC.

The rate of job creation in Europe has slowed. German car manufacturing, which is export focused and a substantial part of its economy, has been impacted by slowing demand and emissions regulations. Vehicles produced reduced to 4.7m in the year to November 2019 vs 5.7m in the prior year. Despite this German unemployment (4.9%) remains near all time lows and wages growth positive.

As a result of resilience in the services and consumer parts of the global economy, and renewed central bank determination not to allow economies to correct, we tend to migrate towards views that we are closer to mid than late economic cycle.

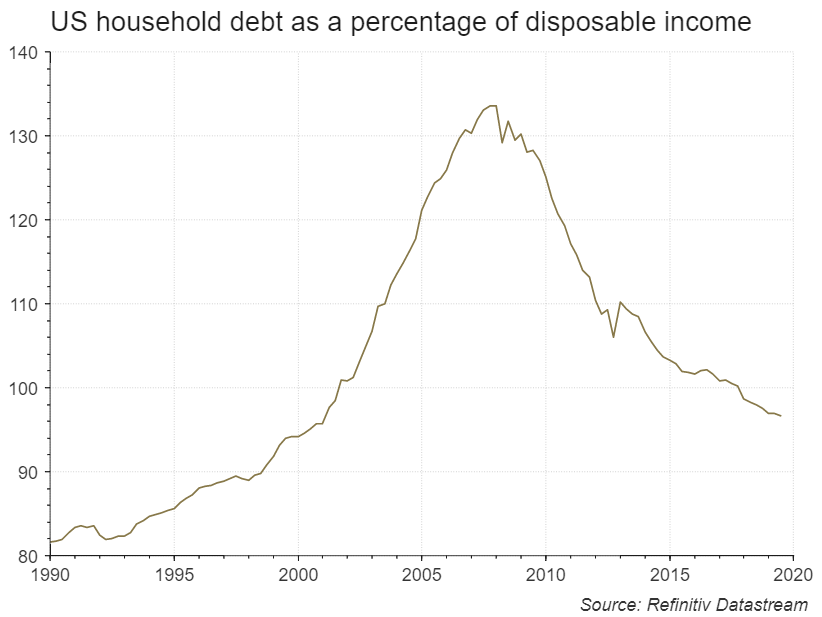

Further to this, and in addition to increased government spending, we see room for increasing consumer spending. The US household has deleveraged and any reversal in behaviour could be very positive for medium term economic activity and consequently company earnings.

US Presidential Election

The outcome of the election in November 2020 may have important implications for the global economy, financial markets and certain business sectors.

Trump is a highly divisive character which has the potential to garner support for candidates in the Democrats that have more revolutionary policy ambitions. Indeed Warren and Sanders have been getting increased attention over the last six months and, in combination, appear to be capturing in excess of a third of nominee polls.

Whilst this is worth paying attention to it would not surprise us if electoral support for the policy agendas and economic models that these candidates present is not as strong as the media leads us to believe. Results in elections in Australia and the UK in 2019 were conclusive.

Consequently a more likely outcome may be a Trump re-election or a victory by a more centrist Democratic candidate such as Biden. He is currently leading the race to be his party’s nominee and polling strongly against Trump on a head to head basis.

| Democratic Candidate | Democratic Nominee Polling | vs Trump |

| Joe Biden | 29% | Biden +4.5% |

| Bernie Sanders | 20% | Sanders +2.6% |

| Elizabeth Warren | 15% | Trump +0.2% |

| Pete Buttigieg | 8% | Trump +1.2% |

| Michael Bloomberg | 6% | Trump +2.7% |

Aggregated Polls December 2019. Source: RealClear Politics

Australian Economy

Post the surprise Coalition election victory the East Coast residential housing market has seen an increasing recovery in demand as evident in Sydney and Melbourne housing prices and auction clearance rates. Retail sales growth has remained solid and may have accelerated into the Christmas period. There is increasing confidence that a recession can be avoided.

Housing construction remains a critical domestic economic driver and job provider. Rolling 12 month housing approvals are now in line with the 20 year average. This will be a medium term headwind to jobs.

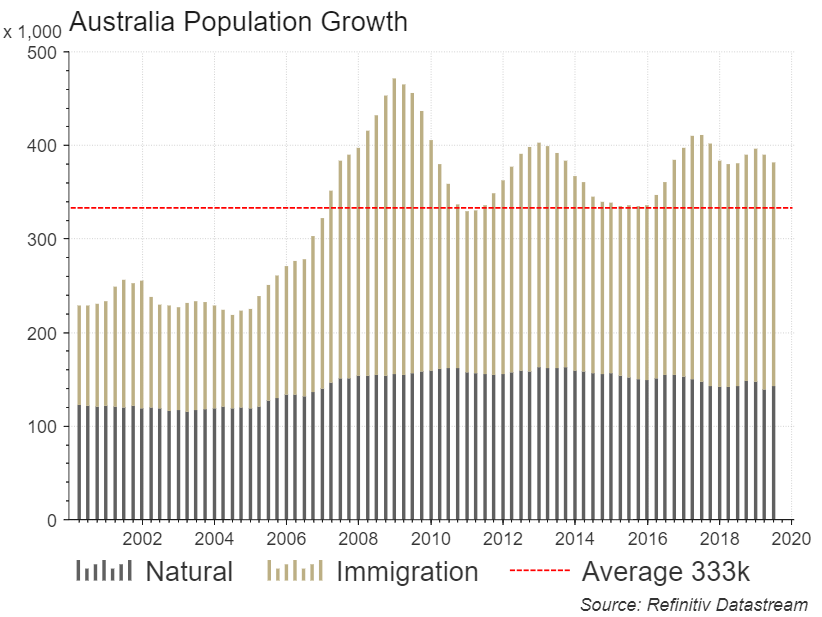

With population growth relatively steady and ~15% above its average for the same period (20 years) there is potential for pockets of excess supply in housing stock to be soaked up within a relatively short period. This bodes well for property developers with ready made land banks. This has formed part of the basis for acquisitions in Cedar Woods and Peet over the past 12 months.

Whilst the risk of a near term domestically led recession is receding Australian households remain highly indebted and very susceptible to any global shock.

As a result, we expect low interest rates in Australia to be with us for a long time. With increasing cost of living pressures households will find it difficult to handle even small rises.

An implication of this is that demand for higher yielding passive property and infrastructure assets will continue to increase. We have made an investment in Primewest Group which is supported by this thematic. Primewest is a Perth based real-estate investor that manages a pool of ~$4bn in commercial and office property assets on behalf of its clients.

Other than interest rates there is potential for the Federal Government to do more to stimulate the economy. With bush fire support announcements there appears to have been a weakening of the previously unrelenting focus on providing budget surpluses. We still feel that there is a plan in place should job market conditions deteriorate.

WA Economy and Residential Property Market

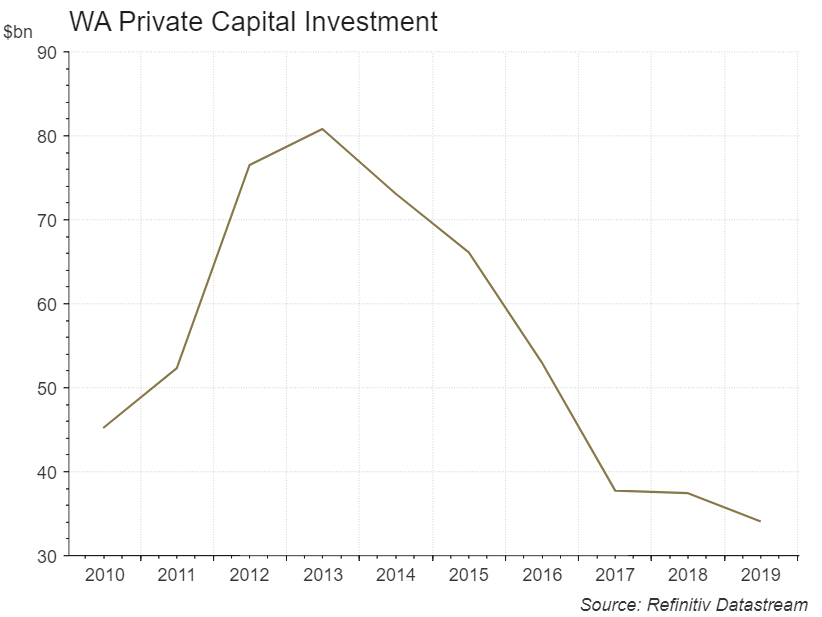

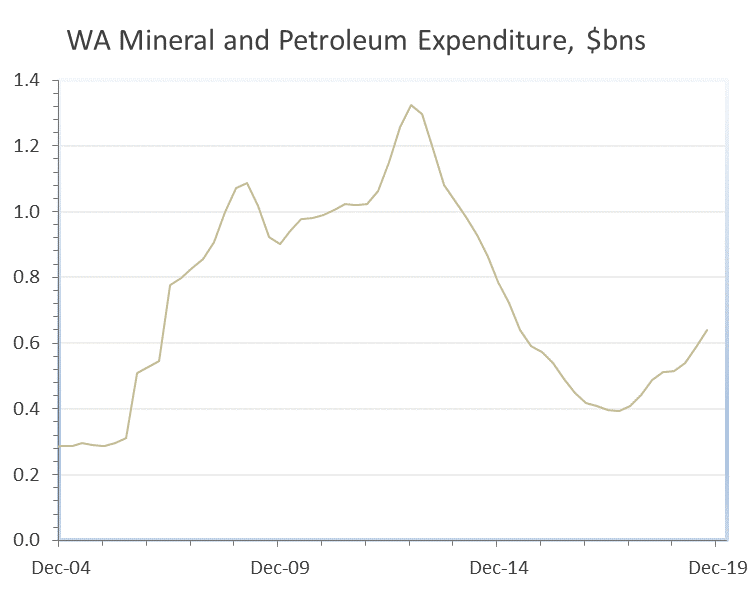

The resetting of the WA economy may now be behind us, albeit signs of a return to broad based growth are early stage and leverage to commodity prices (China) is ongoing.

The outlook for investment in resource projects is again positive, unemployment is reducing, population growth is increasing, retail sales growth is again positive and there are signs that the property market may finally have bottomed.

It is estimated that there are $43bn to $98bn of resource projects in the feasibility stage in WA at present. Woodside’s Scarborough and Browse developments represent a large proportion of this. Total potential projects identified are in excess of $230bn, although more than 40% of this is very early stage (pre-feasibility assessment). Whilst this outlook may result in growth in private capital investment and be supportive of jobs the current slate that are earmarked for near or medium term construction are by no means enough for a return to the halcyon days of 2011 to 2016.

Resource exploration has been increasing which is positive for identifying new projects, although we do not have clarity on what proportion pertains to operators seeking to boost reserves to sustain production of existing mines. In aggregate we expect reserves may have experienced drawdown after a period of tight exploration budgets.

Unemployment has reduced from a peak of 6.5% in January 2019 to 5.7%. This has been assisted by people leaving for other states and a falling participation rate (unemployment data only includes those looking for work). However, jobs are being created. Around 62,000 full time jobs have been added to the economy over the last three years with about 30% of these coming from a recovery in mining employment.

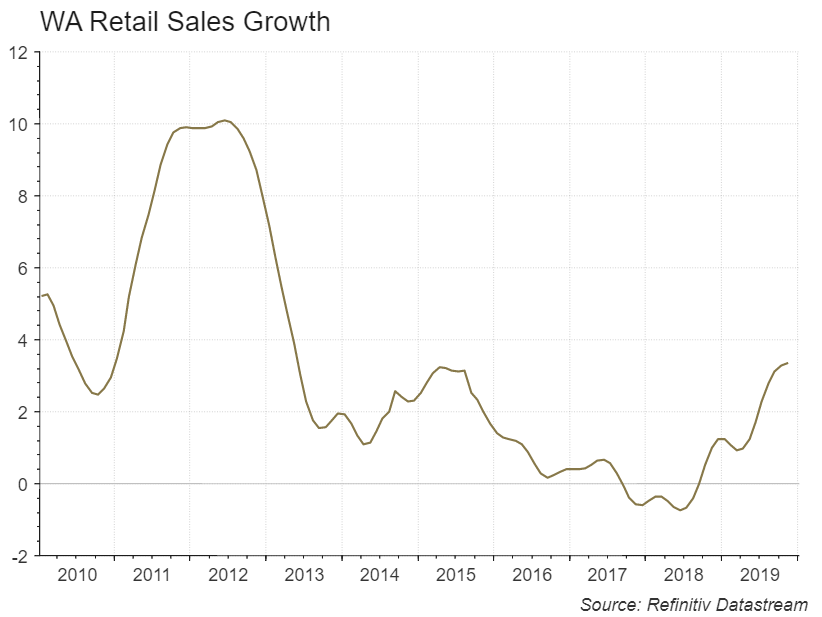

Car sales remain in the doldrums, impacted by changes in lending standards by the banks, however broader retail sales are again growing. This indicates increasing household confidence albeit it is tepid. Positive signs earlier in 2019 of growth in spending in cafes, restaurants and on hardware, which are strong confidence indicators, haven’t been sustained. Rising property prices and some ‘wealth effect’ might be required to get households spending in earnest.

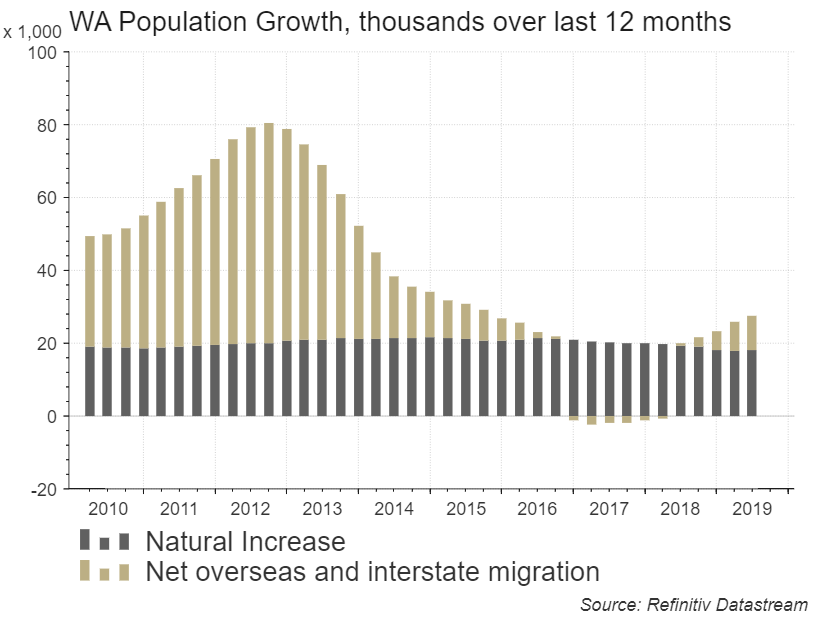

Population growth will be a key ingredient for increasing economic activity and property demand. As per the chart below, WA is again seeing increasing net migration. Underlying this there continues to be a net outflow of population to other Australian states, however, this is reducing with 6,500 leaving in the year to June 2019 vs 14,000 two years earlier.

Overall population growth of ~1.1% per annum is modest relative to other states and a more meaningful catalyst may be required to drive this higher in an environment where job markets on the East Coast are much stronger than they were at the time of WA’s mining construction boom.

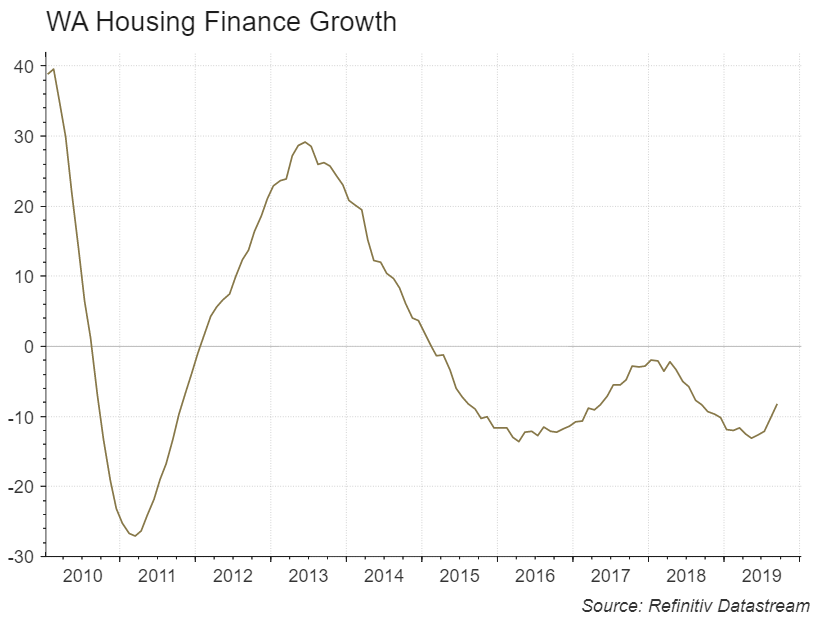

A recovery in bank lending will also be key. Tightening of lending standards post the Financial Services Royal Commission and a general low risk appetite amongst banks for WA is impacting activity and demand for property. Interestingly, the residential property vacancy rate has reduced from 5.5% in 2016 to 2.5% now with a reduction in housing construction and heightened inability of first home buyers to secure loans.

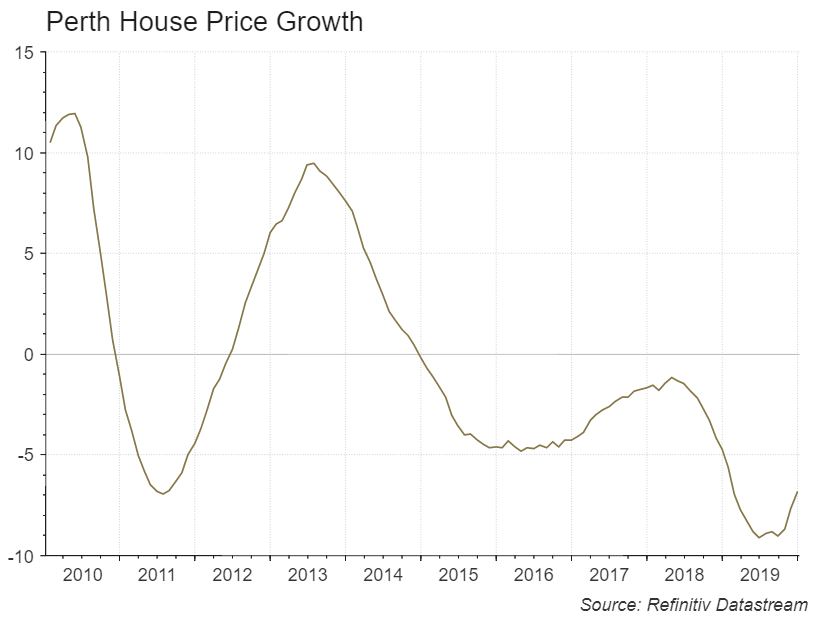

Given the above described playing field we may be close to the bottom of a long drawdown in housing prices. Housing price growth data remains negative at this stage but we have seen anecdotal evidence across the ‘aspirational’ suburbs in the last six months that suggests the market could be turning. If jobs, population growth and lending conditions can all improve there is potential for momentum to build across the broader Perth metro area.

Should more conclusive positive signs emerge we may attract more demand from East Coast and international investors. Perth is now a highly affordable market for a city that is ranked the 14th most desirable city to live in globally. The median house price at the end of 2018 was 5.7x income vs Sydney at 11.7x and Melbourne at 9.7x.

The McGowan government is currently focused on fiscal prudence. However, we see potential for stimulatory measures as we lead into the March 2021 election. Particularly around property market incentives and fees on user pays services to help reduce cost of living pressures on households. These could also be supportive.

Concluding Remarks

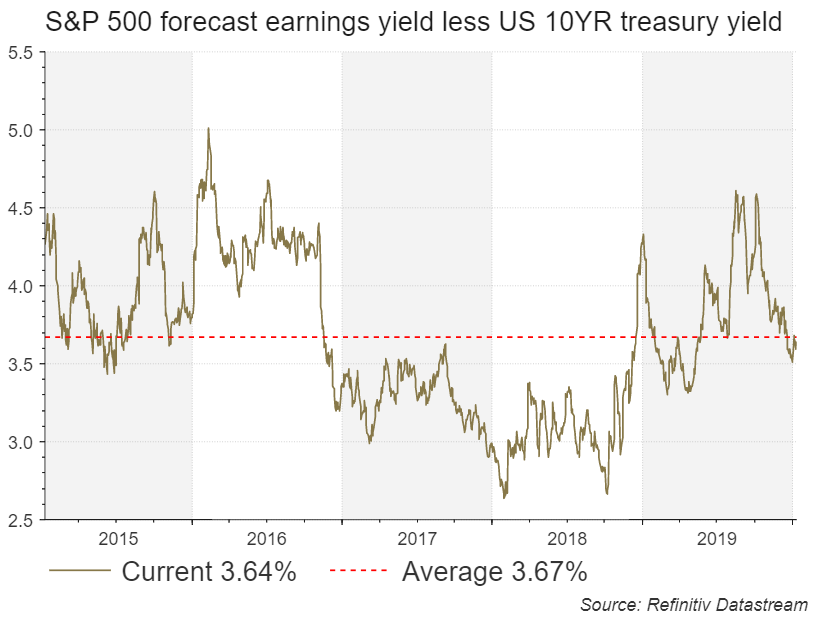

Whilst shares prices have continued to rise and price to earnings ratios are at the higher end of historical ranges, broadly speaking, they are not expensive relative to bonds and earnings growth remains solid. S&P 500 earnings are forecast to grow 9.5% in 2020.

Income returns from cash, term deposits and high quality bonds are below that of inflation (1.7% in Australia) and with low interest rates expected to be here to stay for a long time demand for shares and other risk assets should continue to increase. The RBA has no choice but to keep rates low as highly indebted Australian households with rising cost of living pressures will likely struggle with higher rates. Global central banks are in a similar predicament.

There remains room for fiscal stimulus, domestically and globally, and increased US household consumption could be a catalyst for an acceleration in the cycle.

Given these dynamics we migrate towards views that we are closer to the middle than end of the current expansion.

Volatility will continue to be a feature of markets and geopolitical tensions are likely to be a reoccurring catalyst for these events.

Inflation in not currently a concern but is a perennial risk to the current market utopia. There remain structural headwinds (primarily technology driven efficiencies) as described in our August 2019 newsletter.

The susceptible nature of Australian households to any global economic shocks also leads us to believe that our unhedged exposure to offshore businesses remains prudent.

We will continue to increase exposure to global companies with a focus on sectors that are not available in Australia. In particular there is very limited availability of technology companies. These will lead the next wave of innovation, productivity and wealth creation as the world continues to digitise. Some of the best placed are large incumbents that are investing unprecedented amounts in research and development programs. As such, we have recently taken a position in Microsoft.

Our preference remains to seek excess returns from high quality and liquid shares (equity in businesses that can pass through rising input costs to customers). We have no intention of being drawn into buying low quality debt and other exotic alternatives to generate returns. We have seen a substantial increase in sub investment grade offers in recent times with strong take-up from advisers.

We continue to take a measured approach to the quantum of exposure to shares relative to defensive investments to provide some protection from short term share market volatility. Your agreed investment strategy sets the guidelines for how this is managed.

Investment Committee Update

Alder & Partners welcomed James Telders to its Investment Committee in November 2019. James brings a wealth of global experience to our team having previously worked in investment banking and for the Qatar Investment Authority, a sovereign wealth fund. He is a Charted Financial Analyst (CFA) and originally from Holland.

Steven Tulloch also joined the Committee in 2019. Steve has been working in the financial services industry since 2005 and as an adviser at Alder & Partners since 2013.

Current members of the Committee are as follows. Biographies are available on our website.

David Hadingham (Chairman),

Richard Alder (Deputy Chairman)

Matthew Ward

James Telders

David Alder

Steven Tulloch

This publication is general information only and does not purport to make any recommendation upon which you may reasonably rely without taking further advice. This publication does not take into account any person’s investment objectives, financial situation and particular needs. The information contained within this publication was compiled by Alder and Partners Pty Ltd (AFSL No. 382714) and is based on materials from other sources and we provide no warranty regarding the accuracy or completeness of the information. All opinions, conclusions or forecasts are reasonably held at the time of compilation but are subject to change without notice.