Chinese Share Market Volatility

High levels of volatility have been seen in Chinese share markets over the past week, with some similarities to the experience in July / August 2015. This has driven volatility in broader global markets including our own.

Earlier in the week Chinese authorities tried to stabilise their markets by setting trigger points (down by 5% and 7%) that closed off trading temporarily, but have now removed this feature after it had the reverse impact. Local and international traders became concerned about their ability to get out and it actually increased panic selling. It is believed this has been exacerbated by a lack of understanding amongst local traders who have essentially being treating their share markets like casinos.

There has also been a significant devaluation of the yuan which has created global anxiety surrounding the state of the Chinese economy. Economists have interpreted this as a requirement to support the internal economy.

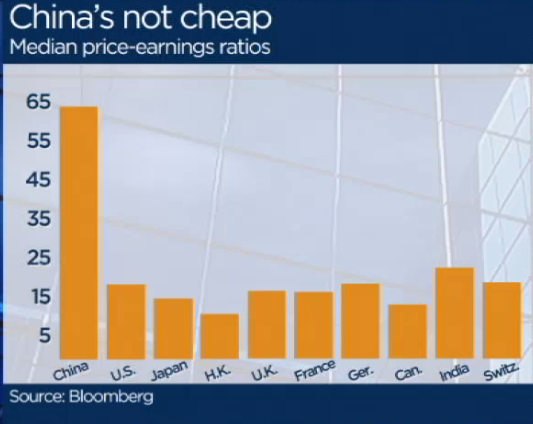

Whilst Chinese authorities are taking several actions to try and stabilise their market including buying shares we expect significant volatility to continue. The following chart illustrates the eye wateringly excessive valuations of Chinese shares, and given this a significant sell off at some stage would seem completely rational.

Source: ABC News & Bloomberg

When this occurs is uncertain as a continuation of this support would seem likely. Whilst this may seem peculiar to us (given these valuations) there are political agendas that are driving their decisions.

With regards to the devaluation of the yuan we tend to subscribe to Magellan Financial Group’s explanation. That is that the currency is being devalued to allow the repatriation of large amounts of foreign reserves without shifting the currency aggressively. Funds are likely being used for a range of purposes including extending economic growth policies, repairing the balance sheets of state enterprises and supporting the share market.

Whilst there are concerns surrounding the Chinese economy we feel it is important to separate these from volatility in their share markets and consequently the impact on earnings of the companies we are invested in.