Market Volatility – Greece and the European Union

As you may have heard the people of Greece voted against the austerity-based proposals of the European Union (EU) and International Monetary Fund (IMF) over the weekend. This has resulted in further uncertainty regarding the country’s continued membership of the EU and/or use of the common currency and placed creditors in a very difficult position. EU leaders are meeting tomorrow and they may be forced to provide concessions to Greece, however, the outcome of this remains very unpredictable as the political ramifications are almost as great as the financial. It is likely that volatility in financial markets may continue or heighten in the coming days.

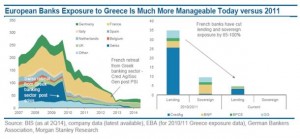

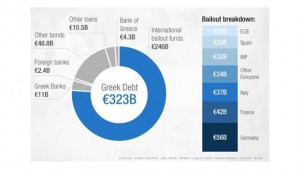

One of the key drivers when concerns first erupted three years ago was that large portions of Greece’s debt were held by financial institutions and a write-off of debt or a default could cause liquidity and solvency issues for the broader European banking system, and then extend to economic impacts for the global economy. This is no longer a significant issue as banks have unwound a large portion of these positions since 2011 and the major owners of Greece’s liabilities are now the IMF, ECB and other EU members that are counterparties to bailout funds.

Whilst the ultimate exposure lies predominantly with European taxpayers (the funders of these organisations/vehicles) and this does have potential economic implications it is our view that the balance sheets of these organisations and countries are sufficiently strong enough to handle a write down of Greek debts in part or full.

Separate to this there are concerns as to how the bond markets for other EU members in delicate positions (such as Italy, Spain and Portugal) may react if Greece is declared bankrupt and is forced to leave the EU and/or common currency. This contagion risk is real but in our view has largely been mitigated by the progress these countries have made over recent years with the reforms required to strengthen their fiscal position. Additionally the ECB has launched its Quantitative Easing (money printing) program which it has indicated it will use aggressively to hold down the borrowing costs of these countries (through further bond purchases). These circumstances give us comfort that as long as these countries do not stray from their programs that the risk of contagion may be contained.

We also emphasise that whilst share prices may be volatile the impact on earnings of the businesses that you are invested in may not be material. There will be some exceptions to this such as companies that sell commodities (as commodity prices will be more volatile) and those whose earnings are linked to the value of investments that are held, however broadly speaking the impact of this should be not be material in the context of your portfolio. This provides us with comfort that share prices should recover once these issues are dealt with, and sentiment improves. Whilst we cannot be certain how this issue will play out a palatable solution to the Greek problems should soon be reached and the focus will return to the impending domestic reporting season, US economy, and outlook for interest rates globally (all of which are more significant issues).

Valuations are not stretched and we are well positioned to take advantage of any further temporary equity market weakness.