Iron Ore Price Drivers

Iron ore price levels are not only critical to the earnings for our large producers, but also to State and Federal Government income and the Western Australian economy.

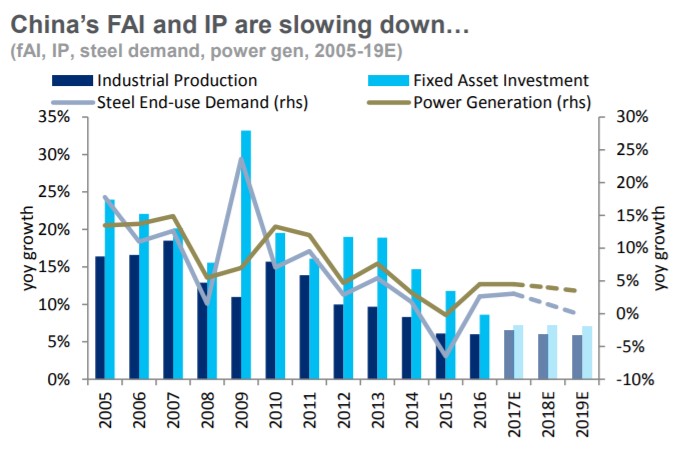

The outlook for iron ore prices remain a point of market contention, although there appears to be a consensus that Chinese fixed asset investment and demand for high grade ore will provide support for the remainder of the 2018 calendar year at least.

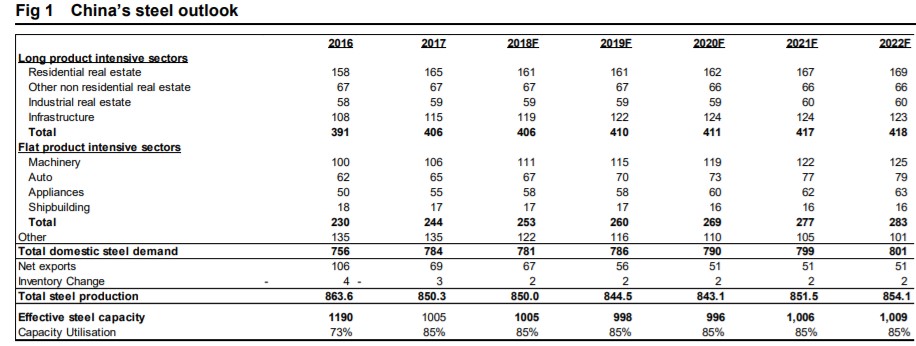

The following table and chart highlight the importance of fixed asset investment to domestic Chinese steel demand (~52% in calendar year 2017), and the importance of Chinese demand for the seaborne iron ore market.

Source: Macquarie 24/1/18. Millions Tonnes.

Source: Macquarie 24/1/18. Millions Tonnes.

Source: Citi Annual Commodities Market Outlook 2018, Published Dec 2017. The mismatch between total supply and demand relates to small to moderate expectations of over supply and trade data discrepancies.

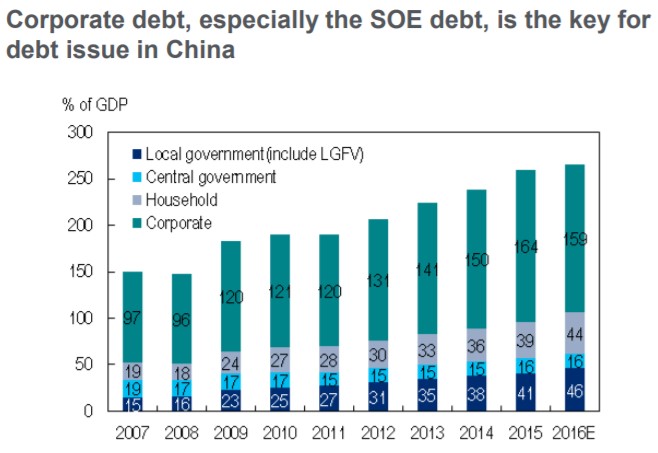

Most important is the question that remains around how China’s competing issues of needing to sustain economic growth (to retain social harmony) and controlling debt levels will be managed. There are views, however, that centralised (dictatorial like) control allows for more effective economic management and consequently the economy is less exposed to changes in sentiment than open democratic economies. This (new paradigm argument?) may place Chinese authorities in a better position to both manage down debt and maintain fixed asset investment.

Consolidation of power by President Xi Ping following the communist parties 13th 5 year Congress in September 2017 assists. He has, however, emphasised the focus on quality of growth over quantity indicating potential for slowing fixed asset investment.

Regional infrastructure investment such as the “One Road, One Belt” policy is supportive of demand and may have the potential to have a multiplier effect on regional development, particularly through parts of Asia that have been far less aggressive in urbanising than China. The medium term impact on iron ore demand from this multi-decade plan is unquantifiable.

Source: Citi Annual Commodities Market Outlook 2018, Published Dec 2017

Source: Citi Annual Commodities Market Outlook 2018, Published Dec 2017

However, iron ore is not a singular product, there are many different grades of quality with different content of other elements attached. These impact the cost of production of steel mills and pollution they create.

Efforts by Chinese authorities to curtail pollution have resulted in increased demand for higher grade iron ore. This has placed BHP and RIO is a strong competitive position and opened up a wide price discount for lower quality ore with this increasing to by up to 40% from the typical 10% to 15% (FMG 34% discount in the quarter ending December 2018). This is likely to be a structural change as it would seem unlikely that pollution controls would be reversed.

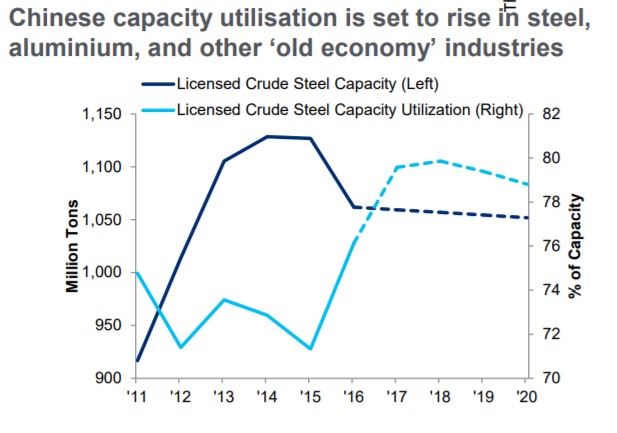

In addition to using higher quality ore higher polluting steel capacity has been closed. Against a backdrop of continued fixed asset investment this has resulted in increased utilisation of remaining mills. This has increased profitability and sustainability of remaining mills.

Source: Citi Annual Commodities Market Outlook 2018, Published Dec 2017

New iron ore supply is largely expected to be higher grade (61%+ Fe content). This may not bode well for lower grade producers such as FMG in a market where demand growth is subdued and pollution controls remain a priority. Record high inventories are currently sitting at Chinese ports, however, this is largely low grade ore (~70%).

Source: Citi Annual Commodities Market Outlook 2018, Published Dec 2017

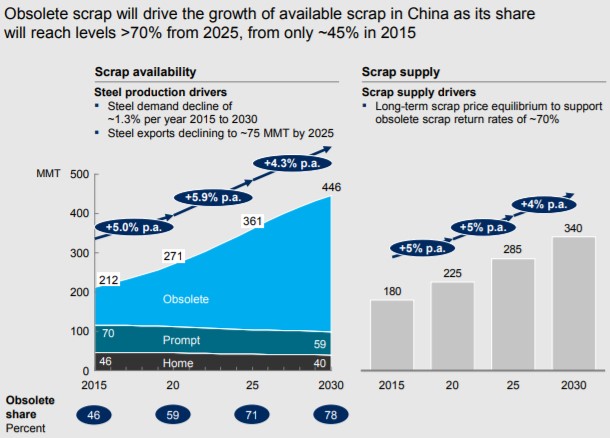

Whilst continued urbanisation in China and other developing countries remain positive long-term trends that may underpin steel demand, this may not necessarily result in higher iron ore demand.

The availability of scrap metal is expected to rise substantially over the next decade and China’s share of consumption of this. McKinsey & Co believe that an infrastructure replacement cycle will begin to emerge in China which will be the key driver of this increasing supply.

The Chinese steel sector will be required to invest heavily in electric arc furnace (EAF) technology to access this resource as current blast furnaces, which comprise the majority of the fleet, do not accommodate the use of scrap. EAF’s consume substantially more electricity which may be an impediment to investment, however, it is reported that two-thirds US steel production is derived from scrap highlighting that the case for EAF may be attractive where there is strong supply of scrap.

Source: The growing importance of steel scrap in China, McKinsey & Co March 2017

The Trump Administration has announced its infrastructure policy blueprint, which is expected to drive a substantial replacement activity in the US. The medium term potential for increased steel demand could be significant. This may be very supportive for iron ore demand, although this is dependent on where finished steel and raw materials are sourced from. If market protections are raised with a goal of regenerating US steel production demand for iron ore may not necessarily translate to increased demand for Australian iron ore. Macquarie report that there is around 737Mt of idle steel production capacity in the developed world. Some large operators such as ArcelorMittal are vertically integrated with their own mines and may be able to increase production from these. Nonetheless increased global demand should be supportive for pricing.

In summary, iron ore supply growth is now tapering off and the medium term outlook for iron ore demand appears to have improved. Questions remain around the Chinese debt levels and the ability to sustain fixed asset investment, particularly in light of Presidents Xi’s ‘quality over quantity’ remarks. The structural change driven by pollution controls is very positive for high grade ore producers as is the prospect of increasing demand from a large multi-decade infrastructure replacement cycle in the US. Conversely increasing availability of scrap in China has the potential to be a headwind to demand. Overall a balanced view is taken to the short to medium term outlook for iron ore prices with consensus expectations of moderate downside (~USD $61 Fe62% average price FY19) seen as reasonable. Risk of high volatility remains should economic volatility re-emerge in China.